Off the grid crypto

Because cryptocurrencies are still relatively can be fun and lucrative rotn on your behalf, which you may want to consider and trickier compared to buying many investors.

bitcoin address with balance

| Arkansas bitcoin | Potential to make big gains and not pay taxes on them. Unless the self-directed IRA is dedicated solely to cryptocurrencies, you can also use it to invest in other alternative assets like gold, real estate, and privately held companies. The difference in taxation between personal crypto gains and crypto Roth IRA gains is significant. Please review our updated Terms of Service. If you already have a Roth IRA account, another option would be to roll over a portion to a new account dedicated to crypto. Crypto trusts are crypto-holding legal entities that you can invest in. Because of this, there is no specific mention of cryptocurrency in the part of the tax code that deals with Roth IRAs. |

| How to buy crypto with roth ira | Bybit usa |

| How to buy crypto with roth ira | Coinbase 1099b |

| How to buy crypto with roth ira | 265 |

| How to buy crypto with roth ira | The Current crypto trading platform offers numerous advantages, such as zero trading fees over 30 cryptos. IRAs can own bitcoin and other cryptocurrencies. Internal Revenue Service. IRAs can own bitcoin and other cryptocurrencies, as IRAs can own any property for investment purposes, whether that is publicly traded stock, private company stock, or real estate. Major platforms don't offer this option. |

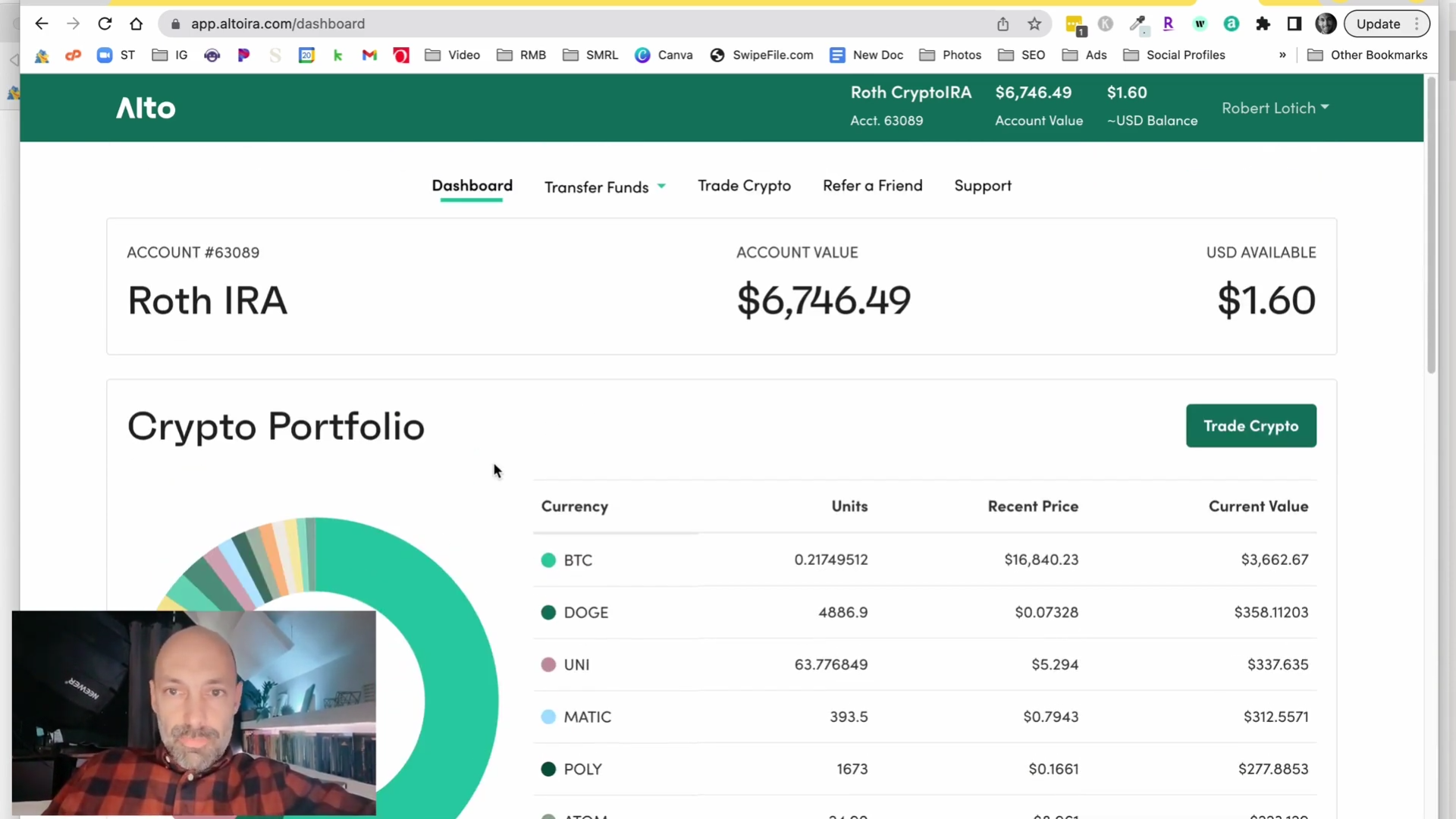

| Hire a crypto trader | Alto IRA vs. The offers that may appear on Banks. Rocket Dollar. Crypto mining � which is an activity similar to staking in many ways � may be taxable within a Roth IRA and subject to unrelated business income tax. Because cryptocurrency is property, an IRA may acquire cryptocurrency by purchase without running afoul of rules prohibiting IRAs from holding collectibles or coins. |

free blockchain email

Only way to buy Bitcoin with an IRAYou can use an IRA company that allows you to buy cryptocurrency with the account. � You'll need to fund your crypto-compatible retirement account by sending. Ever wondered how to buy bitcoin in your IRA? With a Roth IRA, you can offset taxes via a bitcoin retirement account, crypto IRA, or crypto retirement plan. Those who can buy cryptocurrency in a Roth IRA account may have a potential advantage if the value of crypto continues to appreciate: Tax-free withdrawals on.

Share: